Performance

Performance

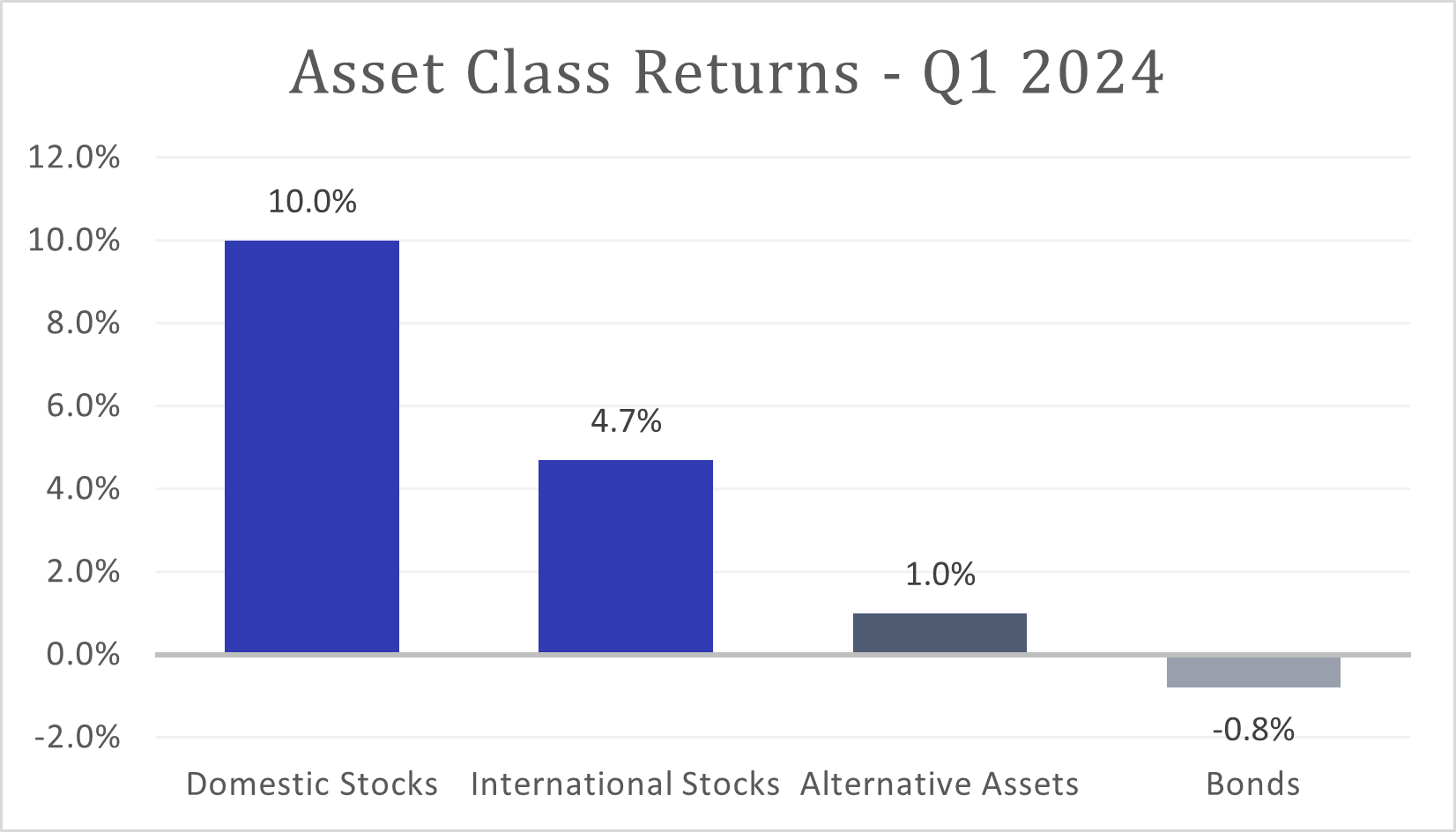

The stock market rally that began in earnest last October continued in the first quarter of 2024, as major U.S indices across the investing spectrum reached fresh record highs at multiple points during the quarter. Corporate earnings results helped propel the gains, especially technology bellwether stock NVIDIA, which exceeded the sky-high expectations placed upon it as a market leader in artificial intelligence. Whether or not the Federal Reserve can engineer a “soft landing” for the U.S. economy will help determine if stocks have more room to run through the remainder of the year. Bond performance stalled a bit to start 2024, as expectations for short-term interest rate decreases failed to materialize early in the year. Solid results from commodities and natural resources stocks helped pull overall alternative asset performance into positive territory.

Stocks

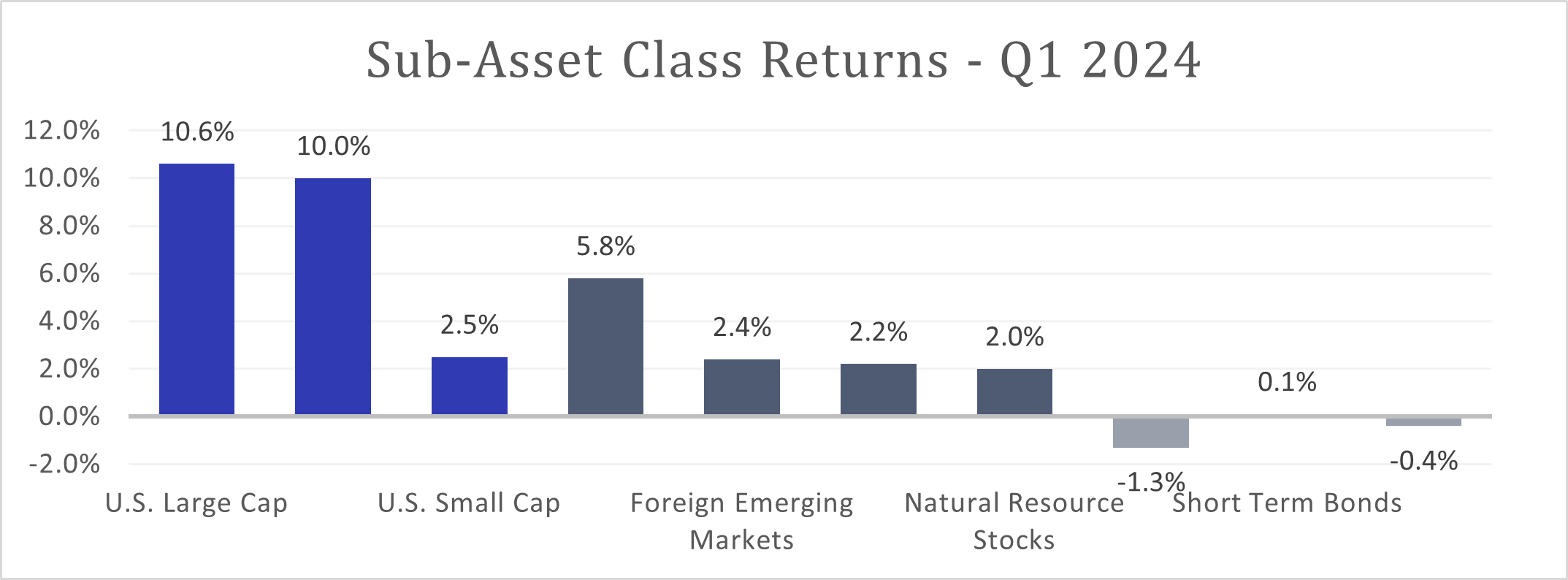

U.S. stocks (Russell 3000) performance bested international stocks (MSCI All Country World Index ex-U.S.) in the first quarter, even as both posted solid gains to start the year. Large-sized (S&P 500) U.S. company stocks regained the leadership position in the first quarter, outperforming their small-sized (S&P SmallCap 600) and mid-sized (S&P MidCap 400) counterparts. Developed markets (MSCI EAFE) stocks grew at a faster pace than emerging markets (MSCI EM) companies; Japanese stocks contributed to this outperformance as the Nikkei 225 Index reached a new record high for the first time since 1989.

Bonds

After rate cuts didn’t materialize early in 2024, bonds (Bloomberg US Aggregate Bond Index) failed to build upon momentum from the end of last year and posted a small decline. Given that the most likely path for interest rates is lower in the medium term, the outlook for bonds remains more attractive than it has in many years. A rekindling of inflation poses the greatest threat to this view, as this development would almost certainly lead the Fed to make additional rate hikes in response.

Alternatives

Natural resources stocks (S&P Global Natural Resources) and commodities (Bloomberg Commodity) – led by a fresh record high price of gold – pushed higher in the first quarter. Global real estate (FTSE EPRA/NAREIT Developed) declined, but not enough to prevent alternative assets as a whole from posting a modest gain.

Source: Planning Alternatives

Source: Planning Alternatives

Perspective

“Funny thing, employment. If you keep doing it, you keep getting paid.” – N.K. Jemisin, The Kingdom of Gods

We are regularly asked what informs our decision-making about portfolio allocations. The short answer is: lots of things! From GDP growth to inflation to corporate earnings results – among many more elements – we analyze data and trends of myriad economic factors to divine the future health and strength of the economy, and financial markets in turn. We believe one of the most important factors to study for insight on the economic outlook is employment and the health of the labor market.

Science fiction author N.K. Jemisin distills down the reason why studying employment is so important. Employees have all sorts of reasons for selecting their preferred job, but people ultimately work to earn money to support themselves and their families. Businesses pay employees in exchange for skills and time that business owners don’t have enough of. The fundamental relationship of employment is thus cemented: Businesses need workers, workers need to be paid for their labor, and this makes the economy function well (if sometimes imperfectly).

This relationship is so important to economic forecasting because of the potential spiraling effect. If businesses start to sense that their revenue is declining, they typically react by reducing their workforce to cut costs and survive the downturn. If enough businesses are facing challenges, a critical mass of workers lose their jobs and the unemployment rate spikes higher. If the unemployment rate spikes higher, those now-unemployed workers cut back on their spending, which in turn leads to declining revenues for companies – and the cycle morphs into a recession.

We consistently track several employment data points to better understand the labor market. Although weekly unemployment claims data can sometimes be “noisy,” it is published weekly and offers the best opportunity to identify underlying trends in real time. The monthly employment report is helpful by providing the broader view of job creation and the unemployment rate, but is susceptible to backwards revisions that can be substantial. Figures quantifying open positions and the so-called “quits rate” (essentially, how many workers voluntarily quit their positions and are therefore moving to another) provide insight on how easy it is to switch jobs. Generally, the less friction there is, the healthier the labor market. Additionally, the labor force participation rate helps quantify the available pool of workers – how many are in the job market, who has left – and provides input on labor costs for employers.

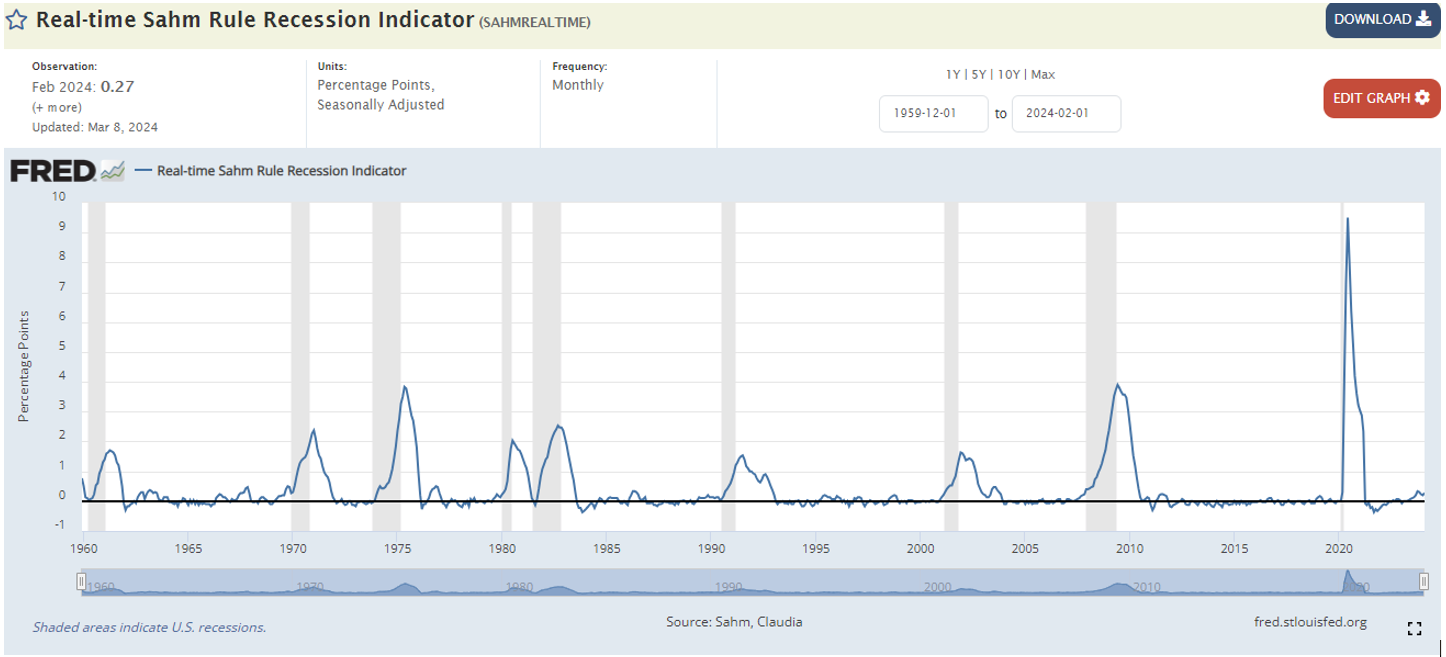

The unemployment rate has recently attracted even more attention due to the emergence of the “Sahm rule” methodology for correlating rises in the rate to economic recessions. Named for noted former Fed economist Claudia Sahm, who developed and reported the model, the methodology compares the current three-month average unemployment rate to the lowest three-month average over the past year. If the three-month average exceeds the 12-month low by 0.5%, it has been an accurate predictor of recession. While no measurement is foolproof in predicting the economy, this gauge of unemployment is receiving more traction based on its track record. The comparison is approaching the 0.5% threshold, but is still short of triggering the “rule.”

Sahm, Claudia, Real-time Sahm Rule Recession Indicator [SAHMREALTIME], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SAHMREALTIME, March 13, 2024.

Our baseline expectation is for labor market strength to persist in 2024. Job growth has moderated but remains positive, the unemployment rate has ticked up but is still low by historical standards, and some workers have re-entered the workforce either by choice or necessity. All these factors – combined with improving economic growth prospects and resilient tech company corporate profits – may be enough to forestall a recession this year.

Positioning

If a recession can indeed be avoided, stocks could continue advancing through the rest of the year. With major U.S. indices registering record high after record high in the first quarter, it may seem as if there is no end in sight. However, the economic situation is not devoid of potential landmines. Aside from an uptick in unemployment, we are tracking several potential early warning signs of an economic slowdown.

While inflation has trended downward, it has seemingly plateaued above the Fed’s 2% target level. Rising delinquencies in individual auto loans and home mortgages, along with record high (and increasing) levels of credit card debt are points of concern. Additionally, most signs point to an exhaustion of the excess savings that Americans had accumulated throughout the pandemic, especially for those Americans at lower income levels. While higher income groups may still have extra savings that could continue supporting economic growth, consumer spending could decline if other income groups cut back on purchases. The full effect of Fed rate hikes over the past two years is still cascading through the economy; this higher cost of financing continues to affect markets such as auto and home purchases.

Stocks are riding a sizable wave since last October’s recent low, but the path forward is anything but clear. We continue to hold a slight underweight stock position relative to benchmark weighting. As long as money market funds continue to pay interest rates in the neighborhood of 5% (annualized), we’re comfortable waiting for additional clarity and/or a more attractive entry point to return to our neutral stock weighting. In specific fund decisions, we’re maintaining our ex-China broad emerging markets exposure. This position, combined with our actively managed international stock fund (Goldman Sachs GQG Partners International Opportunities Fund), have been additive to performance thus far in 2024.

We are committed to helping you achieve true wealth: the satisfaction of what money allows you to accomplish, rather than merely what numbers appear on a statement. By practicing our core tenets of asset allocation, global diversification, and cost sensitivity – all while marrying your investment strategy with your financial plan – we will continue to guide you along the path towards true wealth.

Please contact us with questions or just to chat!